reit dividend tax malaysia

Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. As for the technical fees royalties and other earnings we remind that the tax rate is 10.

There are many tax exemptions in Malaysia which is why the country is quite attractive from this point of view to foreign investors and here we remind the following.

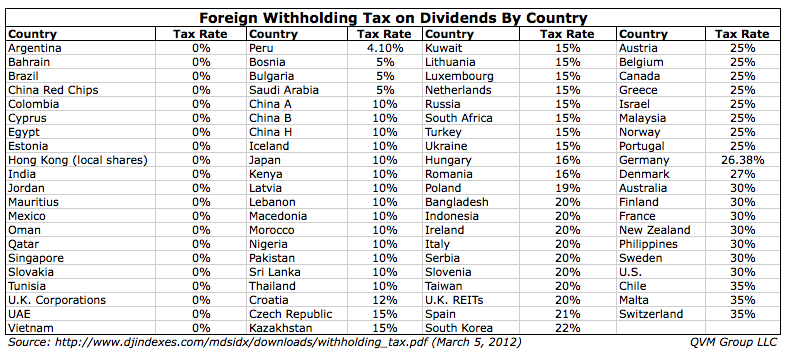

. 2 more Malaysia-listed ETFs that pay decent dividends. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer. As a comparison neighbouring Singapore applies income tax to REIT dividends at a minimum 15 for foreigners.

REIT dividend will be taxed in their tax computation. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

For example if your taxable income was 50000 in 2021 youd be taxed at a rate of 22 for ordinary income distributions paid that year. In Malaysia there are mainly 5 types of REITs. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate.

In Malaysia the companies are levied on incomes and the tax rate is settled at 25. The reduced withholding tax of 10 on individual and non-corporate investors is only available up to 31 Dec 2011. ETF 2 MyETF MSCI Malaysia Islamic Dividend MyETF-MMID0824EA ETF 3 Principal FTSE ASEAN 40 Malaysia ETF CIMBA400822EA No Money Lahs Verdict.

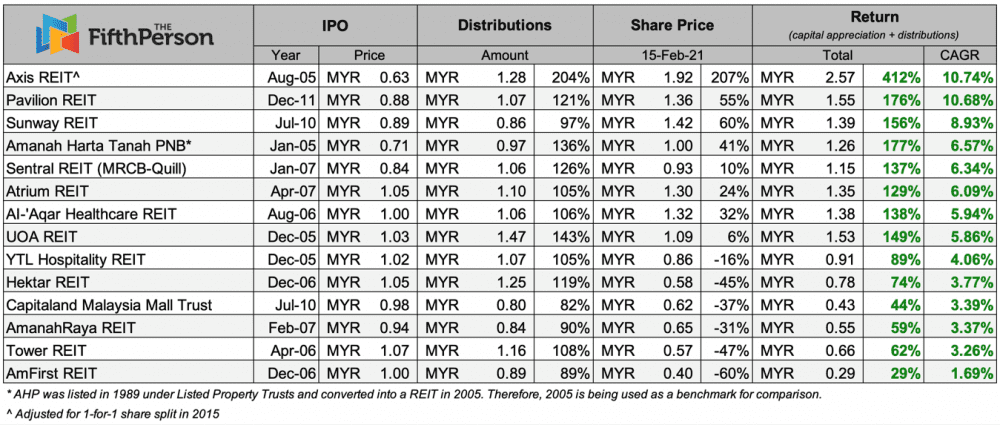

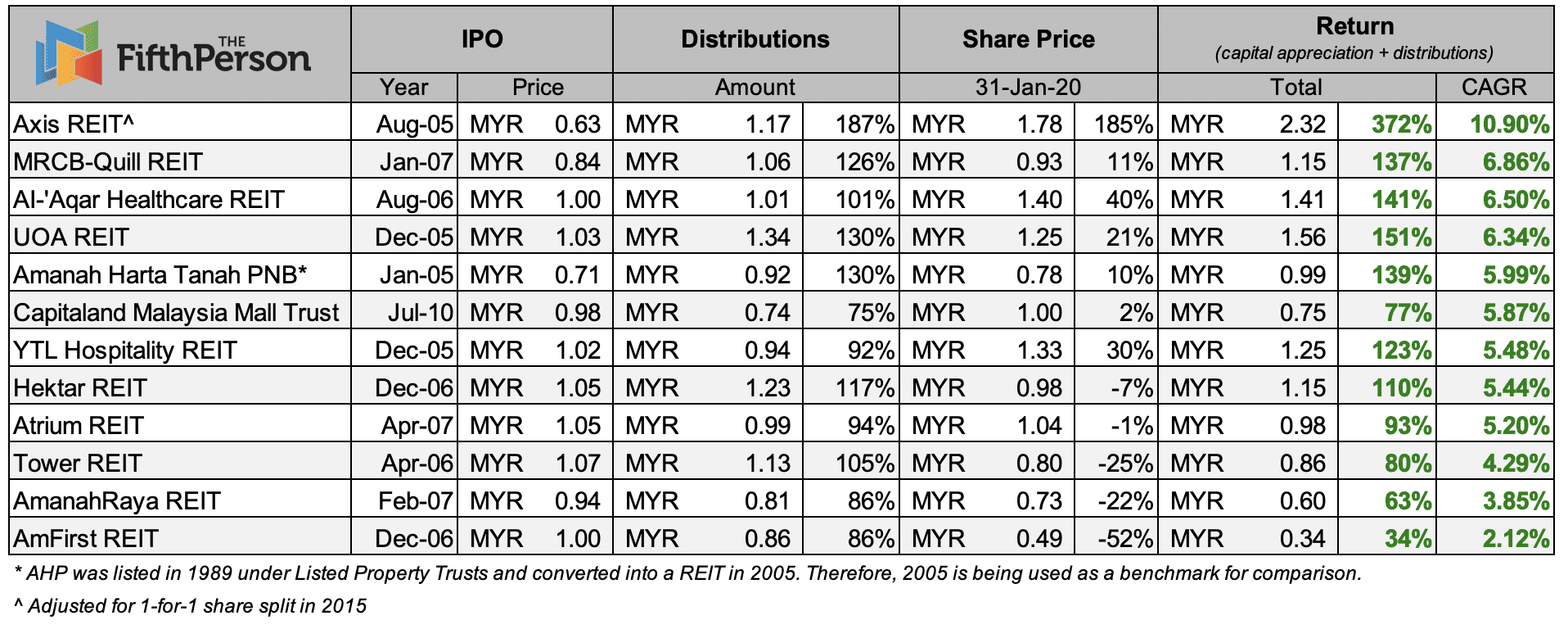

ARREIT has gearing of 4365 and involved in office building educational industrial hotels and. The Malaysian REIT sector as represented by the Bursa REIT Index is dominated by household names in Malaysia such as KLCC Sunway and Pavilion. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

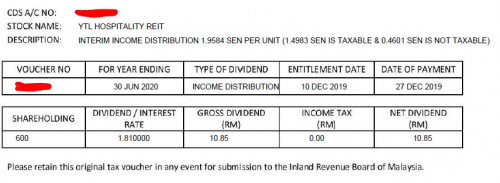

Valuations of some types of employment income are as follows. Starting for the year 2009 tax for REIT dividend is as follows. The reduced withholding tax of 10 on individual and non-corporate investors is only available up to 31 Dec 2011.

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. Hospitality REITs hotels and serviced. Retail REITs shopping malls.

Visit The Official Edward Jones Site. Inland revenue board of malaysia taxation of. AMFIRST REAL ESTATE INVESTMENT TRUST.

It has strong cornerstone investor which is Frasers Centrepoint Trust listed in Singapore. Dividend income forms part of the total income of a REITPTF. For dividends categorized as ordinary income the rate at which you are taxed will vary based on your income and tax bracket.

7 on each item. REITs unit holders are taxed in the year of assessment the distribution is received not the financial year of the REITs. No withholding tax tax-resident company investors.

Another thing that you need to know about TradePlus MSCI Asia ex-Japan REITs Tracker. 19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link. A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at.

For ETFs trades stamp duty will be waived from Bursa Malaysia until 31 December 2025. Gearing is the highest as well at 442. Here we have highlighted the Top 10 REITs in Malaysia by market cap.

Tax credits attached to dividends are given as a set-off to the REITPTF. General company tax of 25 is applicable. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax.

It can reach up to 22 for all individual investors under a progressive tax rate. The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. REIT dividend will be taxed in their tax computation.

It may also earn income from fixed deposits or selling its real estate investments. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for. On the other hand tax exempt income received by REITs and subsequently distributed to unit holders continue to be tax exempt in the hands of these unit holders.

Trusts or Property Trusts REITPTF in Malaysia. New Look At Your Financial Strategy. You are also eligible to deduct up to 20 of qualified business income from.

General company tax of 25 is applicable. Hektar is the first retail focused reit in Malaysia.

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Finance Malaysia Blogspot Understanding Reits

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

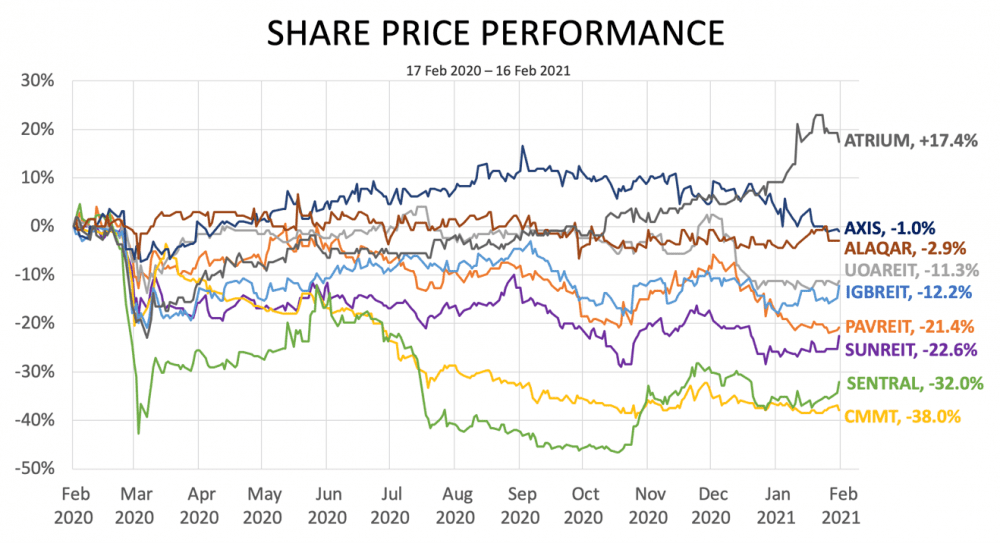

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

What Are The Cons Of Investing In Reits In Malaysia

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

Why Invest In Reit S Wma Property

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

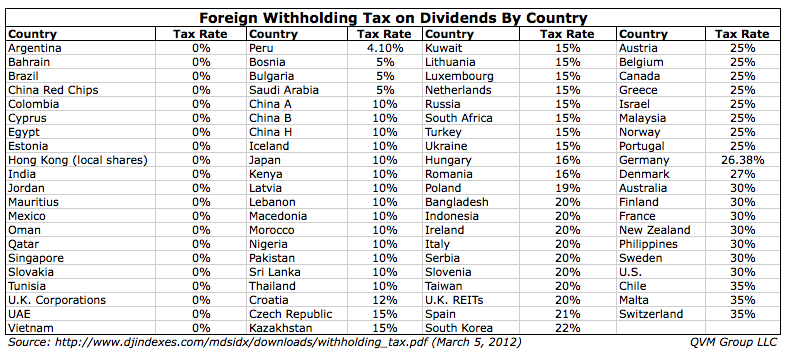

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

How Are Individual Reit Holders Taxed Thannees Articles

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com